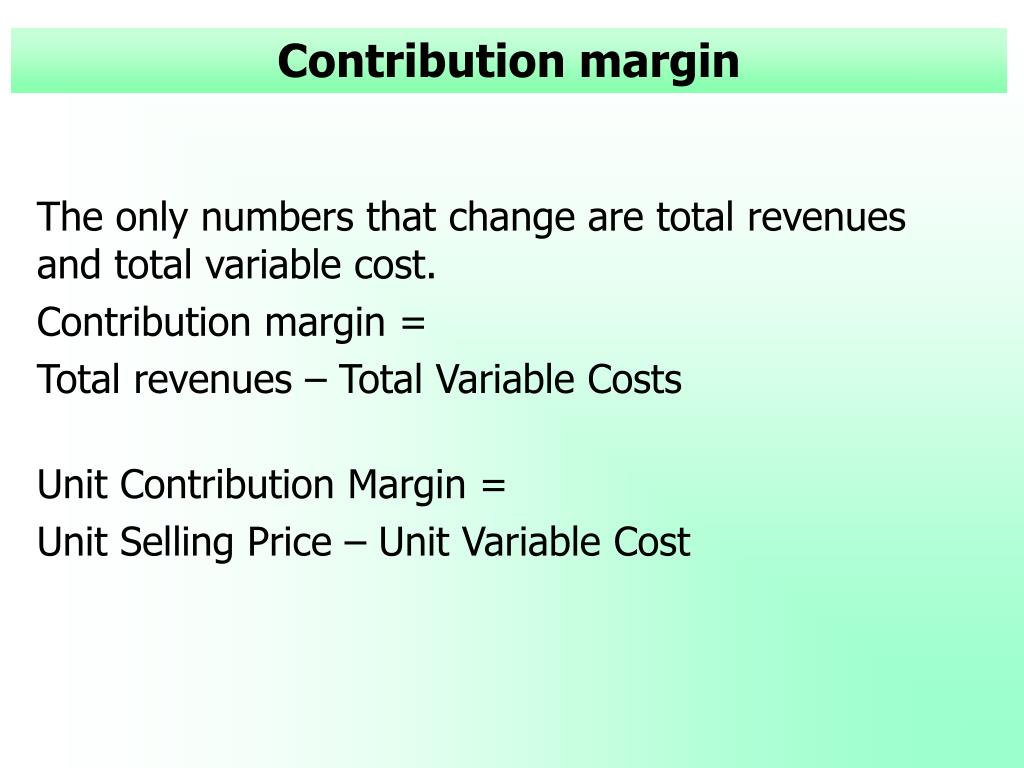

If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you. You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio. As mentioned above, the contribution margin is nothing but the sales revenue minus total variable costs. Thus, the following structure of the contribution margin income statement will help you to understand the contribution margin formula.

Who Should Use the Contribution Margin Formula?

Company XYZ receives $10,000 in revenue for each widget it produces, while variable costs for the widget are $6,000. The contribution margin is calculated by subtracting variable costs from revenue, then dividing the result by revenue, or (revenue – variable costs) / revenue. Thus, the contribution margin is 40%, or ($10,000 – $6,000) / $10,000. The contribution margin can be stated on a gross or per-unit basis. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs.

Table of Contents

- And as we mentioned earlier, a negative margin indicates the cost of producing the product exceeds its revenue.

- The contribution margin can be stated on a gross or per-unit basis.

- Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit.

- To cover the company’s fixed cost, this portion of the revenue is available.

- A high contribution margin indicates that a company tends to bring in more money than it spends.

Fixed costs include periodic fixed expenses for facilities rent, equipment leases, insurance, utilities, general & administrative (G&A) expenses, research & development (R&D), and depreciation of equipment. The contribution margin income statement separates the fixed and variables costs on the face of the income statement. This highlights the margin and helps the cheat sheet for debits and credits illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public.

How do you find the contribution margin per direct labor hour?

Any remaining revenue left after covering fixed costs is the profit generated. It is important to assess the contribution margin for break-even or target income analysis. The target number of units that need to be sold in order for the business to break even is determined by dividing the fixed costs by the contribution margin per unit. Understanding the distinction between fixed and variable costs is crucial for managers looking to make informed decisions and drive profitability. Fixed costs — such as rent, insurance and salaried employees — remain constant regardless of how much a business produces or sells. Whether it manufactures 200 widgets or 20,000, that rent bill remains.

The contribution margin ratio for the birdbath implies that, for every \(\$1\) generated by the sale of a Blue Jay Model, they have \(\$0.80\) that contributes to fixed costs and profit. Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin. Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits.

The higher a product’s contribution margin and contribution margin ratio, the more it adds to its overall profit. In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set.

A good contribution margin is one that will cover both variable and fixed costs, to at least reach the breakeven point. A low contribution margin or average contribution margin may get your company to break even. Use contribution margin alongside gross profit margin, your balance sheet, and other financial metrics and analyses. This is the only real way to determine whether your company is profitable in the short and long term and if you need to make widespread changes to your profit models.

Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products. Furthermore, a contribution margin tells you how much extra revenue you make by creating additional units after reaching your break-even point. Imagine that you have a machine that creates new cups, and it costs $20,000. To make a new cup, you have to spend $2 for the raw materials, like ceramics, and electricity to power the machine and labor to make each product. Below is a breakdown of contribution margins in detail, including how to calculate them.