Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows. Contribution margin calculation is one of the important methods to evaluate, manage, and plan your company’s profitability. Further, the contribution margin formula provides results that help you in taking short-term decisions. As broadening the tax base and raising top rates are complements not substitutes a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently. These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc. For League Recreation’s Product A, a premium baseball, the selling price per unit is $8.00.

Our Team Will Connect You With a Vetted, Trusted Professional

Fixed costs are often considered sunk costs that once spent cannot be recovered. These cost components should not be considered while making decisions about cost analysis or profitability measures. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold. In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. The following are the steps to calculate the contribution margin for your business.

Does the Contribution Margin Calculation include Services Revenue?

As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. Fixed costs are costs that are incurred independent of how much is sold or produced. Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost.

Is Contribution Margin Higher Than Gross Margin?

Knowing your company’s variable vs fixed costs helps you make informed product and pricing decisions with contribution margin and perform break-even analysis. Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05. The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits.

- Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them.

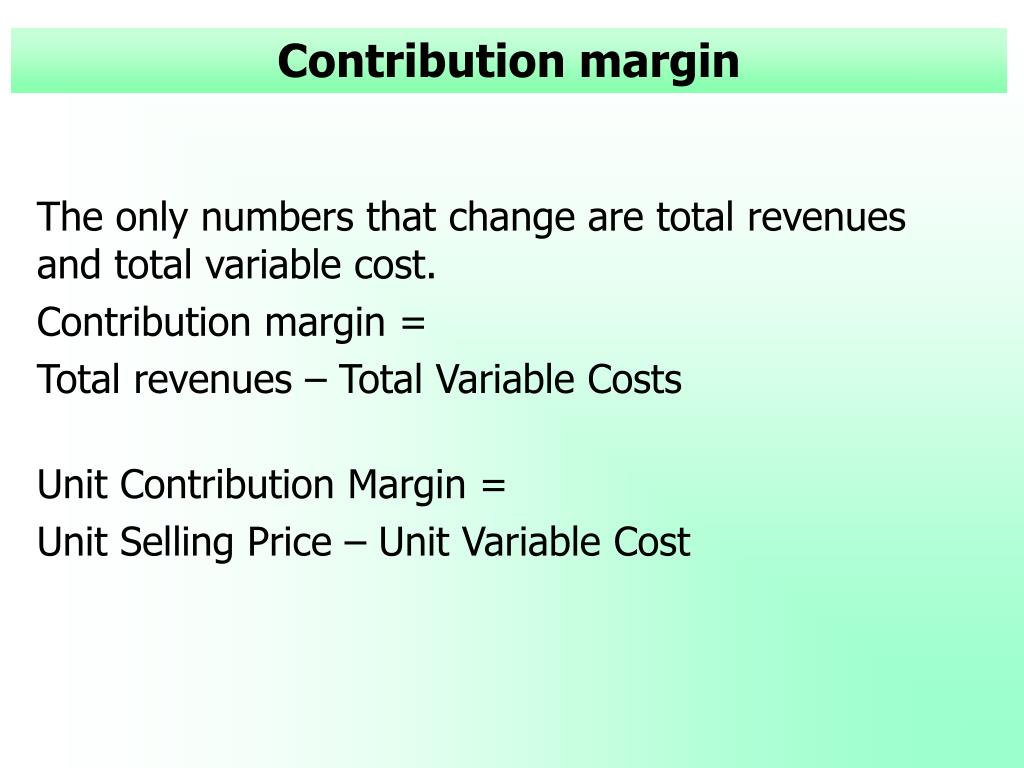

- Contribution margin is a business’s sales revenue less its variable costs.

- Either way, this number will be reported at the top of the income statement.

- Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit.

- Calculating your contribution margin helps you find valuable business solutions through decision-support analysis.

Formula to Calculate Contribution Margin Ratio

Crucial to understanding contribution margin are fixed costs and variable costs. A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales.

The following frequently asked questions (FAQs) and answers relate to contribution margin. Evangelina Petrakis, 21, was in high school when she posted on social media for fun — then realized a business opportunity. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. As of Year 0, the first year of our projections, our hypothetical company has the following financials.

The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. You may need to use the contribution margin formula for your company’s net income statements, net sales or net profit sheets, gross margin, cash flow, and other financial statements or financial ratios. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line.

The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand. The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. Alternatively, the company can also try finding ways to improve revenues. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price.

To cover the company’s fixed cost, this portion of the revenue is available. After all fixed costs have been covered, this provides an operating profit. The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products.